Overview

In the highly regulated and customer-centric health insurance industry, providing quick, accurate, and personalized responses to member inquiries is crucial. However, as health insurance companies grow and their member bases expand, managing the increasing volume of customer inquiries can become overwhelming. These companies often struggle with delayed response times, overburdened support teams, and a decline in member satisfaction. The need for a scalable, efficient solution that maintains high-quality service while adhering to strict regulatory requirements is critical.

The MoE Automation Platform offers a powerful solution designed to revolutionize customer service automation. By automating key aspects of member support, this platform enables health insurance companies to maintain high standards of service while managing growing demand. From automatically categorizing and routing member inquiries to generating instant responses and integrating with existing systems, the MoE platform transforms customer service into an intelligent, efficient, and scalable operation.

While this use case focuses on health insurance, the MoE Automation Platform is designed to be adaptable across various industries. Whether you’re in finance, retail, or technology, our AI-powered customer service automation can streamline your operations and enhance customer satisfaction.

Challenge

A leading health insurance provider was facing significant challenges as its member base rapidly expanded. The customer service team was overwhelmed by a high volume of member inquiries, many of which were repetitive and routine. These included questions about coverage details, claim status, and policy information. The sheer volume of these inquiries led to delays in response times, contributing to member dissatisfaction and increased complaints.

Members were frustrated with the slow response times, often having to wait up to two weeks to receive a resolution. The average touch points per inquiry were as high as 5-6, resulting in lengthy back-and-forth communications that drained the efficiency of the support team. Additionally, the average time spent on each ticket was approximately 4.5 hours, putting a strain on the support team and increasing operational costs.

Solution

The health insurance provider implemented the MoE Workflow Automation Platform to address these challenges. The platform’s AI-powered customer service automation capabilities provided a comprehensive solution that transformed the company’s support operations. Here’s how it worked:

- Automated Inquiry Categorization and Routing:

The platform automatically categorized incoming member inquiries based on their content. Routine inquiries, such as those regarding claim status or coverage information, were routed to intelligent customer service agents, while more complex questions were directed to the appropriate specialists. This ensured that each inquiry was handled by the most suitable resource, improving both efficiency and accuracy. - Instant, AI-Generated Responses:

For common and repetitive inquiries, the MoE platform generated instant responses using the provider’s knowledge base, which included policy information, coverage details, and regulatory guidelines. These responses were personalized by integrating member data from the CRM, ensuring that each reply was relevant and specific to the member’s situation. This not only reduced response times but also enhanced the overall member experience, exemplifying the benefits of AI-powered customer service. - Member Data Integration:

The platform seamlessly integrated with the company’s existing CRM and policy management systems, allowing it to pull in relevant member information such as policy details, claim history, and previous interactions. This data was used to personalize responses and ensure that members felt understood and valued, even when interacting with automated systems, thereby enhancing the intelligent customer service experience. - Human-in-the-Loop Oversight:

While automation handled the bulk of the inquiries, the platform also featured human-in-the-loop oversight for more complex or sensitive cases, such as those involving appeals or disputes. This hybrid approach ensured that critical decisions and nuanced member issues were addressed with the appropriate level of human judgment, maintaining a high standard of service and compliance with health regulations. - Scalability and Compliance:

The MoE platform was designed to scale with the company’s growth and meet strict regulatory requirements. As member inquiries increased, the platform easily adjusted to handle the additional volume without requiring significant changes or additional resources. Its ability to ensure compliance with industry regulations provided the company with peace of mind, knowing that automated responses adhered to necessary guidelines.

Results

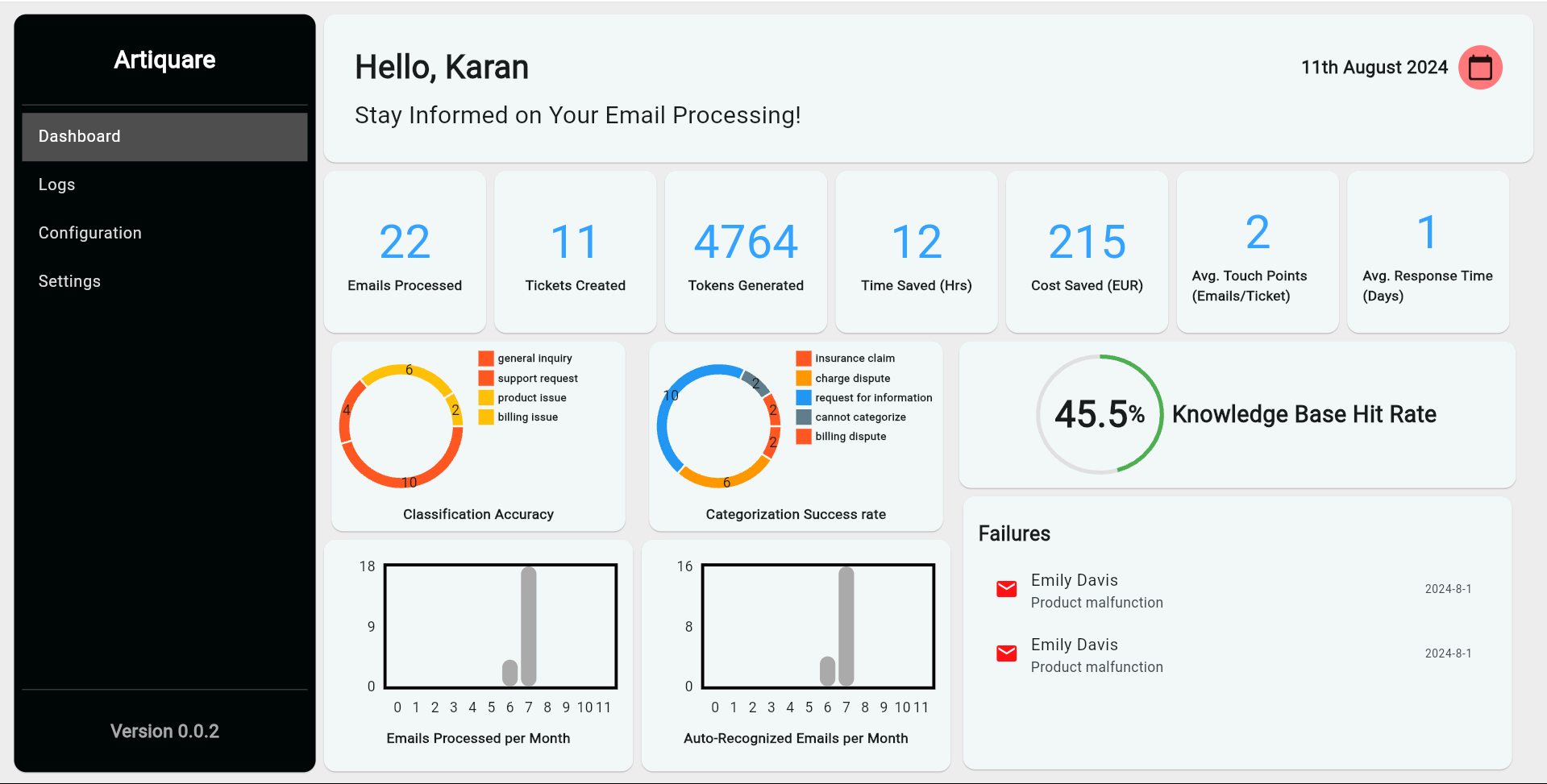

The implementation of the MoE Workflow Automation Platform delivered transformative results for the health insurance provider:

- Reduction in Average Touch Points:

The average number of touch points per inquiry was reduced from 5-6 to just 2-3, significantly streamlining the communication process and reducing member frustration, a clear win for customer service automation. - Dramatic Improvement in Response Times:

The company was able to reduce its response time from up to two weeks to within just two days. This rapid improvement greatly enhanced member satisfaction and decreased the number of follow-up inquiries, demonstrating the power of AI-powered customer service. - Reduction in Time Spent on Tickets:

The average time spent on each ticket dropped from 4.5 hours to just 25 minutes. This massive reduction in handling time allowed the support team to manage more inquiries with the same resources, leading to increased productivity and lower operational costs. - Increased Member Satisfaction:

With faster, more accurate responses, member satisfaction scores improved by 30%. Members appreciated the personalized interactions and the quick resolution of their issues, leading to higher retention rates and positive feedback. - Enhanced Efficiency and Team Focus:

The automation of routine tasks allowed the customer service team to focus on more complex and rewarding member interactions. This not only improved the overall efficiency of the team but also boosted morale, as agents were able to engage in more meaningful work that required their expertise. - Scalable and Compliant Solution:

The platform’s ability to scale with the company’s growth ensured that the company could continue to provide high-quality customer service, even as its member base expanded. During peak periods, such as open enrollment or claim submission deadlines, the platform handled the increased volume with ease, ensuring compliance with all relevant regulations.

Conclusion

The MoE Automation Platform proved to be a transformative solution for the health insurance provider’s customer service operations. By automating routine tasks, integrating seamlessly with existing systems, and providing a scalable and compliant solution, the platform enabled the company to meet the demands of a growing member base while maintaining high levels of service quality and regulatory compliance.